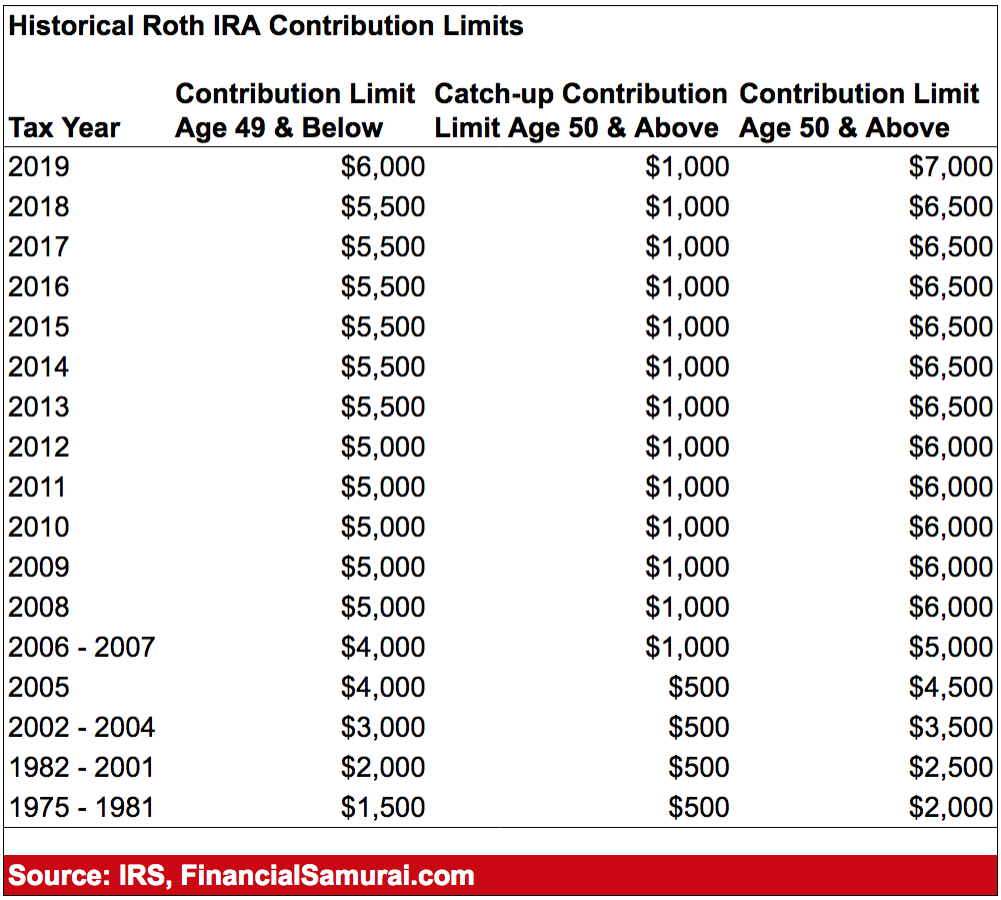

Roth Ira Contribution Limits 2025 Based On Income. Who can contribute to a roth ira? In 2025, this increases to $7,000 or $8,000 if you're age 50+.

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 tax year was $6,500 or $7,500 if you were age 50 or older. For individuals under 50, the roth ira contribution limit in 2025 is $7,000, a $500 increase from 2025.

For 2025, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older.

401k Annual Limit 2025 Reeva Celestyn, For 2025, the roth ira’s contribution limit is $7,000. In 2025, this increases to $7,000 or $8,000 if you're age 50+.

The IRS announced its Roth IRA limits for 2025 Personal, Your ability to contribute to a roth ira is based on your income and tax filing status. For people age 50 or older, the contribution limit is $8,000.

The IRS just announced the 2025 401(k) and IRA contribution limits, The roth ira contribution limit for 2025 is $6,500 for those under 50, and $7,500 for those 50 and older. You can add $1,000 to that amount if you're 50 or older.

Why I Never Contributed To A Roth IRA But Why You Probably Should, Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000. Less than $230,000 (married filing jointly) or less than $146,000 (single)

2025 Simple Ira Contribution Ilise Leandra, Your ability to contribute to a roth ira is based on your income and tax filing status. Ira account holders can contribute up to $7,000 in 2025, which is a $500 jump over the 2025 cap.

Tax Rules 2025 Danya Nancie, Your roth ira contribution may be reduced or eliminated if you earn too much. If you are 50 and older, you can contribute an additional.

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. Eligibility to deduct your contributions is phased out based on your income.

What Is The Ira Contribution Limit For 2025 2025 JWG, For tax year 2025, the roth ira contribution limits are $7,000 for individuals under the age of 50. If you are 50 and older, you can contribute an additional.

Why Most Pharmacists Should Do a Backdoor Roth IRA, If your earned income is less than the above limits, you cannot contribute. For 2025, the roth ira’s contribution limit is $7,000.

2025 Contribution Limits Announced by the IRS, But there are income limits that restrict who can contribute. For 2025, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older.

For those 50 or older, the limit is $8,000, up by $1,000, allowing older savers to accelerate their retirement savings.